Overview

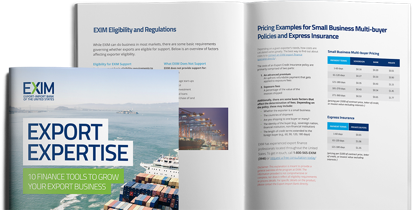

By protecting exporters' accounts receivable, Express Insurance is a product that provides significant benefits with little hassle. Express Insurance is designed for small exporters that have some but limited experience exporting, or are relatively new to exporting. Featuring free credit reports on foreign buyers and a streamlined application, Express Insurance empowers exporters to overcome obstacles in the way of increasing international market share.

The protection of a policy equips exporters with the confidence needed to chart a path forward with margins they can depend on. Companies can increase their global competitiveness by offering credit terms needed to win sales. Moreover, Express Insurance empowers exporters to overcome cash flow challenges by borrowing against their insured receivables.

Use Express Insurance to:

- Insure against nonpayment by international customers.

- Cover both commercial (e.g., bankruptcy) and political (e.g., war or the inconvertibility of currency) risks.

- Obtain credit reports on foreign buyers (up to ten) the exporter elects to insure (these are complimentary though they remain with EXIM).

- Arrange financing through a lender by using insured receivables as additional collateral.

Benefits of Express Insurance:

- Dedicated EXIM Credit Risk Management Expertise: ease the burden of credit risk management by leveraging EXIM's expansive international resources and expertise in evaluating potential foreign customers

- Risk Reduction: safeguard against catastrophic losses from buyer nonpayment.

- Increased Competitiveness: unlock the ability to offer buyers the credit necessary to expand into new markets and boost sales with existing customers.

- Improved Liquidity: accelerate cash flow by borrowing against foreign receivables.

How it Works

The nuts and bolts of a policy are simpler than one might imagine.

- Policies cover both commercial and political risks at 95%.

- Sovereign buyers are covered at 100%. Bulk agricultural commodity exports qualify for 98% coverage

- Insuring existing foreign buyers is optional

- EXIM reviews and approves all creditworthy buyers

- There are no application fees or minimum annual premium. A one-time, refundable advance deposit of $500 is required to issue the policy

- Fixed premium rates are based on the payment terms of the sale regardless of the buyer’s country

- No first-loss deductible

- After holding the policy for three years, policyholders successfully graduate to another EXIM product that best fits their growing export needs

How to Qualify

- Exporter meets the Small Business Administration (SBA) small business definition

- Exporter’s three-year average export credit sales are ≤ $10 million (excluding sales to Canada and secure payment terms such as cash, letter of credit, or sight drafts)

- Exporter has 10 or less buyers and no more than 5 years of experience exporting on credit terms